Top 3 Takeaways From My Time Talking to Josh Brown at #WealthStack

- Doug Oosterhart, CFP®

- Sep 13, 2019

- 3 min read

If you're not familiar with Josh Brown, you should be. He's one of the few people to speak the truth about markets and investing during his almost daily bits on CNBC. When he's not on CNBC, he works as the CEO of Ritholtz Wealth Management, which is an investment advisory firm based in New York City. The Ritholtz team basically played a key role in putting on the WealthStack conference that took place in Scottsdale, AZ earlier this week. The conference itself was facilitated around how technology is making a difference in the world of financial planning and investing.

Josh and I kind of got talking by accident. I was spending a few minutes enjoying the weather out by the pool near my room (the resort had a few pools, and this one happened to be the least crowded). A few minutes later, Josh and a few others came out there and we began chatting.

Here are the top 3 takeaways I had during our conversation.

Although being a trader may sound sexy, oftentimes they don't pay any consideration to the tax liability of their trades.

Taxes play a key role in investing and planning. I asked Josh about whether or not the traders on the CNBC desk actually sit around and trade all day. He said that they did. However, one thing to think about was that they really only care about the short-term potential return - their trades don't take into account taxes when talking about them on TV. Taxes may or may not be an issue for traders on the CNBC desk, but for the average investor, they should be something to think about before trying to be an active trader.

What clients truly care about above everything else is growing, optimizing, and protecting their wealth.

We got talking about clients, how our firms operate, and more. One thing that came up was what clients truly care about. The point was made that you can be the best planner in the world, but if someone invests $1,000,000 and their account grows to $1.1 million, they'll generally like you, even if you're a sub-par planner. If the client's account declines to $900,000, even if you're the best advisor in the world, the client might still be concerned. It's important to set expectations for the client. Planning is definitely important, but in the eyes of the client, it still might take a back seat to their perceived importance of investment return.

Some of the best DIY investors still value advice for this reason...

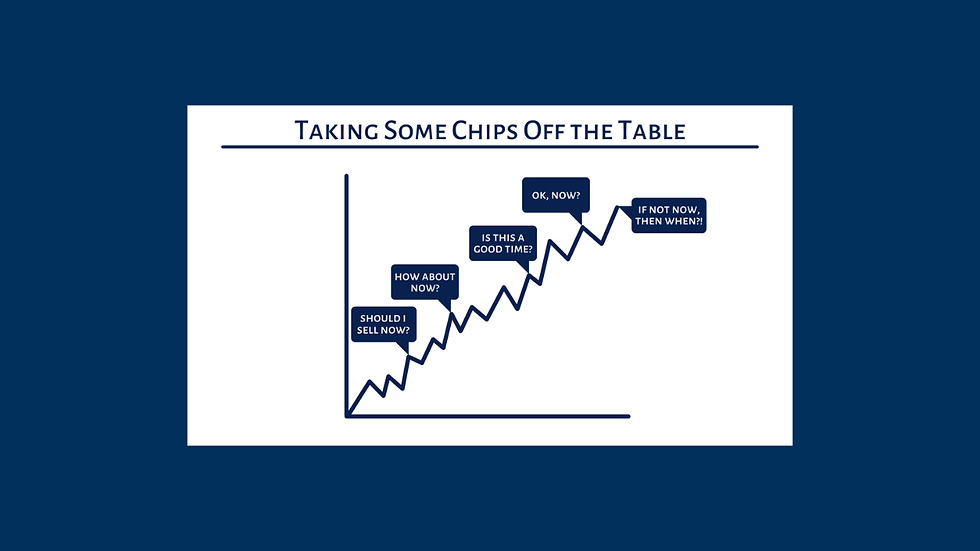

There is generally an emotional attachment that clients have toward their money. I mean, they've spent most of their life accumulating their life savings and the last thing they want to do is lose it. For DIY investors, the emotional attachment can be a great one - they feel a sense of pride in making their investment decisions. However, the smartest DIYers know that because they have this emotional attachment, the help of an unemotionally attached third party could help prevent them from making poor investment choices during retirement. It's like giving a family member advice - sometimes they'll get pissed at you even if the advice is in their best interest. However, if they got the same advice from an unemotionally involved third party, they might digest the advice and act on it. Having the ability to remove emotions when making investment decisions can play a big role in investing success.