October 2025: Volatility and Resilience in Financial Markets

- Doug Oosterhart, CFP®

- Oct 31, 2025

- 6 min read

October 2025 was a month of contrasts for financial and stock markets, blending record highs with sharp pullbacks amid Federal Reserve actions, robust corporate earnings, and geopolitical developments. The ongoing U.S. government shutdown delayed key data releases, heightening uncertainty, while AI-driven optimism clashed with tariff tensions and inflation concerns. Despite these headwinds, major indices showed resilience, with the S&P 500 closing the month up more than 2%. Here's a recap of the month's standout events..

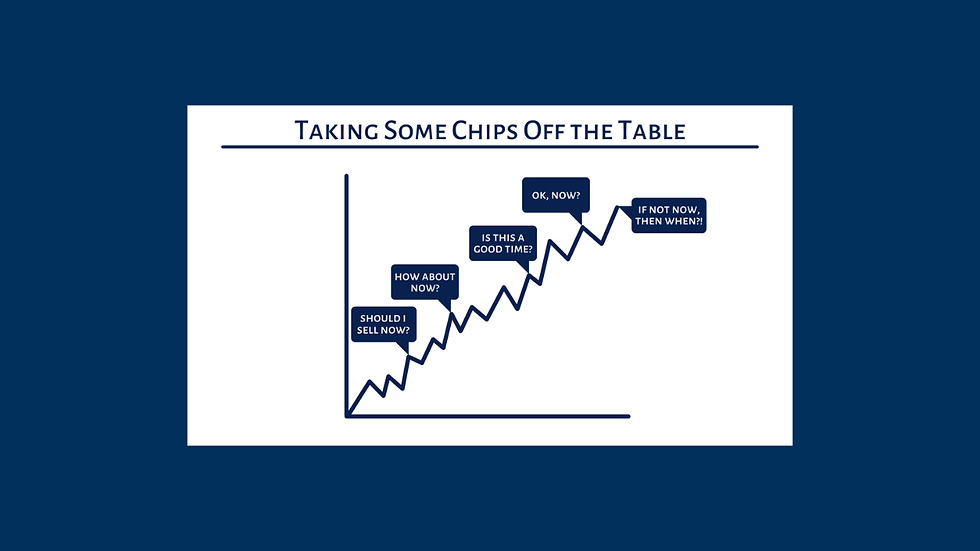

Record Highs Amid Volatility

U.S. equities experienced a rollercoaster ride, with the S&P 500 posting record closes multiple times, including on October 27 and 28, driven by U.S.-China trade optimism and AI enthusiasm. The index surged 1.2% on October 27, marking its first close above 6,800. However, volatility spiked later, with a 1.9% Dow drop on October 10 following tariff threats, and a tech-led selloff on October 30 dragging the S&P 500 flat after a $17 trillion rally from April lows.

The Nasdaq Composite closed the month up ~5%.. The Dow Jones Industrial Average closed the month up more than 2%. Overall, the S&P 500's year-to-date gain stood at around 16-17%, underscoring a bull market entering its third year.

Federal Reserve's Second Rate Cut with Caution

The Federal Reserve's October 28-29 meeting delivered a widely anticipated 25-basis-point cut to the federal funds rate, bringing it to 3.75%–4.00%—the second reduction in 2025 after September's move. The FOMC vote was 10-2, with dissenters favoring a larger 50-basis-point cut or no change. Chair Jerome Powell emphasized data dependency amid the government shutdown's data drought, noting "strongly different views" on December's path and calling another cut "not a foregone conclusion." Markets priced in a 94.6% chance of a December cut pre-meeting, but Powell's hawkish tone tempered expectations, pushing bond yields higher and contributing to a post-announcement dip.

Trade Tensions and U.S.-China Breakthrough

Geopolitical risks flared early with President Trump's October 10 threat of "massive" tariffs on China over rare earth export curbs, erasing gains and causing the Dow to tumble 1.9% and Nasdaq 3.6%. The U.S. government shutdown, starting October 1, exacerbated uncertainty by delaying economic reports. Relief came on October 30 with a Trump-Xi summit in Busan yielding a trade truce: reduced tariffs on semiconductors and energy, plus China's $84 billion market injection. This boosted sentiment, with analysts at Wolfe Research forecasting market gains, though the deal was viewed as mostly priced in.

Stellar Q3 Earnings Season

Third-quarter earnings exceeded expectations, with 86.2% of 130 reporting S&P 500 firms beating estimates—well above the 67% long-term average. Blended year-over-year earnings growth hit 10.5%, up from prior forecasts, with revenues up 6.5% (7.1% ex-energy). Key highlights included:

Nvidia: Hit $5 trillion market cap milestone, shares up 3% on October 29 after AI supercomputer deals.

Alphabet: Up 5% post-earnings on 50% YTD gains, leading Magnificent Seven.

Meta Platforms: Plunged 11% on October 30 after a $16 billion charge and raised AI capex to $91–$93 billion for 2025.

Microsoft: Down 3% despite beats, amid AI spending concerns.

Apple and Amazon: Apple beats Q4 estimates on top and bottom lines, but iPhone revenue comes up short. Amazon stock spikes as AWS revenue jumps 20% year over year.

Chevron and ExxonMobil: Record production drove beats, with Chevron up on Hess acquisition. Sector breadth was strong, with 84.2% beats overall; analysts project 11.0% CY 2025 growth.

Economic Indicators Amid Data Delays

The government shutdown stalled official releases, forcing reliance on private surveys:

Inflation: Delayed September CPI expected at 3.1% (up from 2.9%), but PMIs showed easing tariff pressures; goods inflation ticked higher per Powell.

Job Market: ADP added 14,250 jobs in early October (weak); unemployment steady at 4.3%.

PMI: Global PMI at 52.7 in September (solid 2.7% annualized GDP); U.S. services PMI up, manufacturing contracting.

GDP: Atlanta Fed's GDPNow at 3.9% for Q3; forecasts slowed to 1.7% amid shutdown drag (0.1–0.2% GDP hit per week).

Consumer Confidence: Fell amid tariffs and shutdown; LEI down 0.5%. Global growth revised up but risks tilted down per IMF's October WEO.

Volatility and Sector Rotation

The VIX rose 4.4% on average, hitting pandemic-like spikes early but compressing to 16 by month-end. Tech rotated out late, with Nvidia (-1.5% some days) and Meta leading declines on AI capex worries; cyclicals like industrials (+3%) and financials outperformed. Gold hit $4,000 for the first time on October 7 amid safe-haven bids. Small-caps (Russell 2000) gained on rate cuts.

Crypto and Global Markets

Bitcoin tested $117,000 resistance but closed at a three-day low near $114,000, rebounding off its 200-day SMA. Stablecoins grew under the Genius Act. Globally, STOXX Europe 600 rose on U.S. easing; Nikkei dipped on tech woes; China's indices rallied post-injection. Emerging markets up 31% YTD despite volatility.

Geopolitical and Policy Headwinds

The shutdown shaved GDP growth, with consumers unfazed short-term but long-term risks from delayed data. Trump's failed Fed interference bid lingered, evoking "Liz Truss moments" in bonds. Bank of Japan and ECB held rates steady.

Investment Opportunities and Risks

High valuations (forward P/E 22.4, Shiller CAPE high-30s) signal 60% "bear signposts" per BofA, risking a 10–20% correction. AI capex projected at $300B+ in 2025 offers upside in Nvidia (fair value +20%) and semis like Qualcomm. Undervalued plays: Rocket Lab, DoorDash.

Looking Ahead

October 2025 highlighted markets' AI-fueled resilience against policy storms, with earnings and trade truces providing buffers. November focuses on shutdown resolution, December Fed decision, and Q4 GDP. Investors should eye labor data and tariffs, favoring diversified cyclicals amid elevated risks.

Sources:

Bloomberg: Tech Stocks Slide on Meta’s Big AI Spending Plans: Markets Wrap, October 30, 2025

Bloomberg: Stock Market Today: Dow, S&P Live Updates for Oct. 28, October 28, 2025

Bloomberg: Stock Market Today: Dow, S&P Live Updates for Oct. 29, October 29, 2025

Yahoo Finance: Stock Market News for Oct 28, 2025, October 28, 2025

Investopedia: Markets News, Oct. 10, 2025: Stocks End Sharply Lower, October 10, 2025

Charles Schwab: Schwab's Market Open Update, October 30, 2025

Yahoo Finance: Stock Market News for Oct 30, 2025, October 30, 2025

Reuters: Wall Street closes lower, pausing record-setting rally, October 9, 2025

Nasdaq: Stock Market News for Oct 13, 2025, October 13, 2025

Magellan Financial: Stock Market Commentary– October 2025, October 13, 2025

Yahoo Finance: How major US stock indexes fared Friday, 10/10/2025, October 10, 2025

Yahoo Finance: Stock Market News for Oct 10, 2025, October 10, 2025

Fortune: The S&P 500 is close to market peak, October 22, 2025

Bloomberg: Stock Market Today: Dow, S&P Live Updates for Oct. 30, October 30, 2025

FinancialContent: S&P 500 Financials Navigate Choppy Waters, October 29, 2025

24/7 Wall St.: Stock Market Live October 29, October 29, 2025

Chase: Federal Reserve Cuts Rates at October Meeting, October 30, 2025

Federal Reserve: Implementation Note issued October 29, 2025

USA Today: Fed reduces interest rate by a quarter point, October 29, 2025

Morningstar: What to Expect from the October 2025 Fed Meeting, October 26, 2025

MarketScreener: Corporate earnings calendar for October 31, 2025, October 31, 2025

MarketScreener: Corporate earnings calendar for October 30, 2025, October 29, 2025

Reuters: Wall Street indexes post record closing highs, October 28, 2025

TipRanks: These Are the Stocks Reporting Earnings Today – October 31, 2025, October 31, 2025

Comerica: October 2025 U.S. Economic Outlook, October 6, 2025

S&P Global: Week Ahead Economic Preview: Week of 20 October 2025, October 16, 2025

S&P Global: Monthly PMI Bulletin: October 2025, October 7, 2025

IMF: World Economic Outlook (October 2025) - Real GDP growth

X Post by @USCorpFilings: $SDST Stock Listing Update, October 31, 2025

X Post by @MalawiStock: MSE Daily Market Summary 31 October 2025, October 31, 2025

X Post by @humanatr: Tech Billionaires Net Worth, October 31, 2025

X Post by @Stock_N_Talk_: AMC Dark Pool Trading October 2025, October 31, 2025

X Post by @RedefineWealth: Stock Market Updates October 31, 2025, October 31, 2025